Advance Charges

Advance Charges

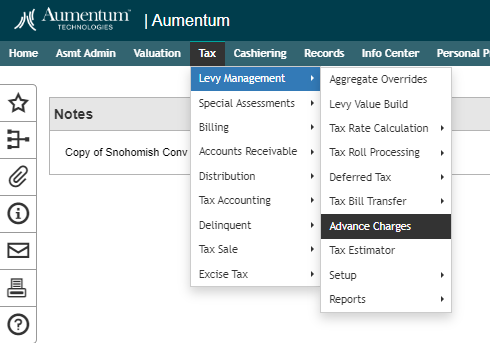

Navigate: Tax > Levy Management > Advance Charges

Description

Aumentum Advance Charges Wizard. This guide will help you navigate through the three steps of the wizard to efficiently manage advance charges for properties. Follow the steps outlined below for a seamless experience.

The purpose of an Advance Charge billing in Snohomish County, Washington, is related to the collection of property taxes in cases where personal property is being removed from the state, dissipated, sold, or otherwise disposed of in a manner that may jeopardize the collection of taxes. Here are the key points:

Distraint and Sale of Property: When the county treasurer believes that personal property is at risk of being removed or sold in a way that may hinder tax collection, the treasurer can prepare papers for distraint. These papers contain information about the property, including the amount of taxes owed and accrued interest. The treasurer can then seize sufficient goods and chattels belonging to the taxpayer to cover the taxes, interest, and costs.

Purpose: The purpose of these advance charge billings is to ensure that property taxes are collected even if the property is at risk of being removed or sold before the annual tax levy. It allows the county to secure the tax revenue and prevent potential losses due to property changes or removals.

This process helps the county maintain tax revenue continuity and ensures that property owners fulfill their tax obligations, even when circumstances may pose a risk to tax collection.

![]() Jurisdiction Specific Information

Jurisdiction Specific Information

Steps

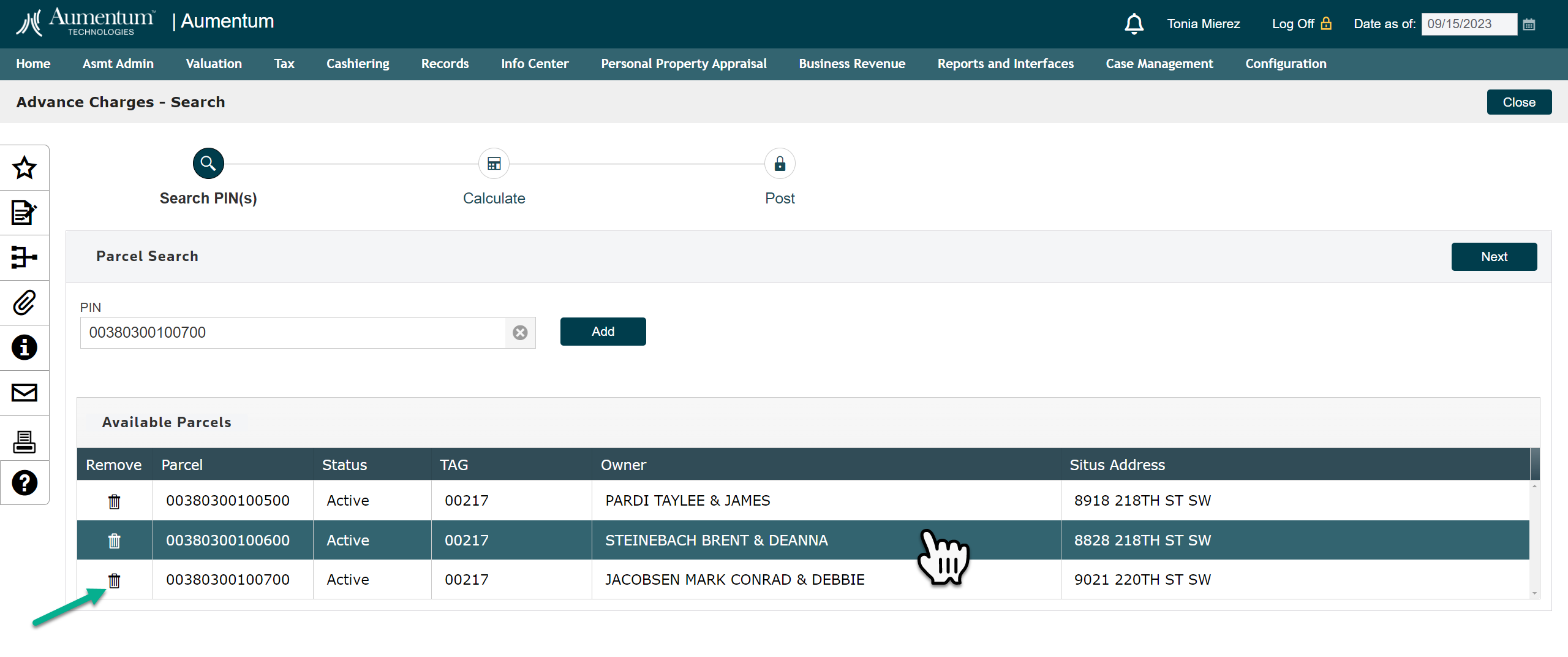

Step 1: Search PIN(s)

-

In this step, you will enter the parcel number(s) or PINs for which you want to assess an advance charge.

-

Click the [ADD] button

-

The record will be highlighted in the grid

-

-

Click [NEXT]

-

If multiple records (PINs) are added to the grid the first record entered will be selected by default, if you wish to process a different PIN, select the record to be processed before clicking [NEXT].

Deleting Records (PIN(s) that were added to the wizard in error)

If you need to remove a property from the grid, follow these steps:

-

Click on the [TRASH CAN] to remove the row.

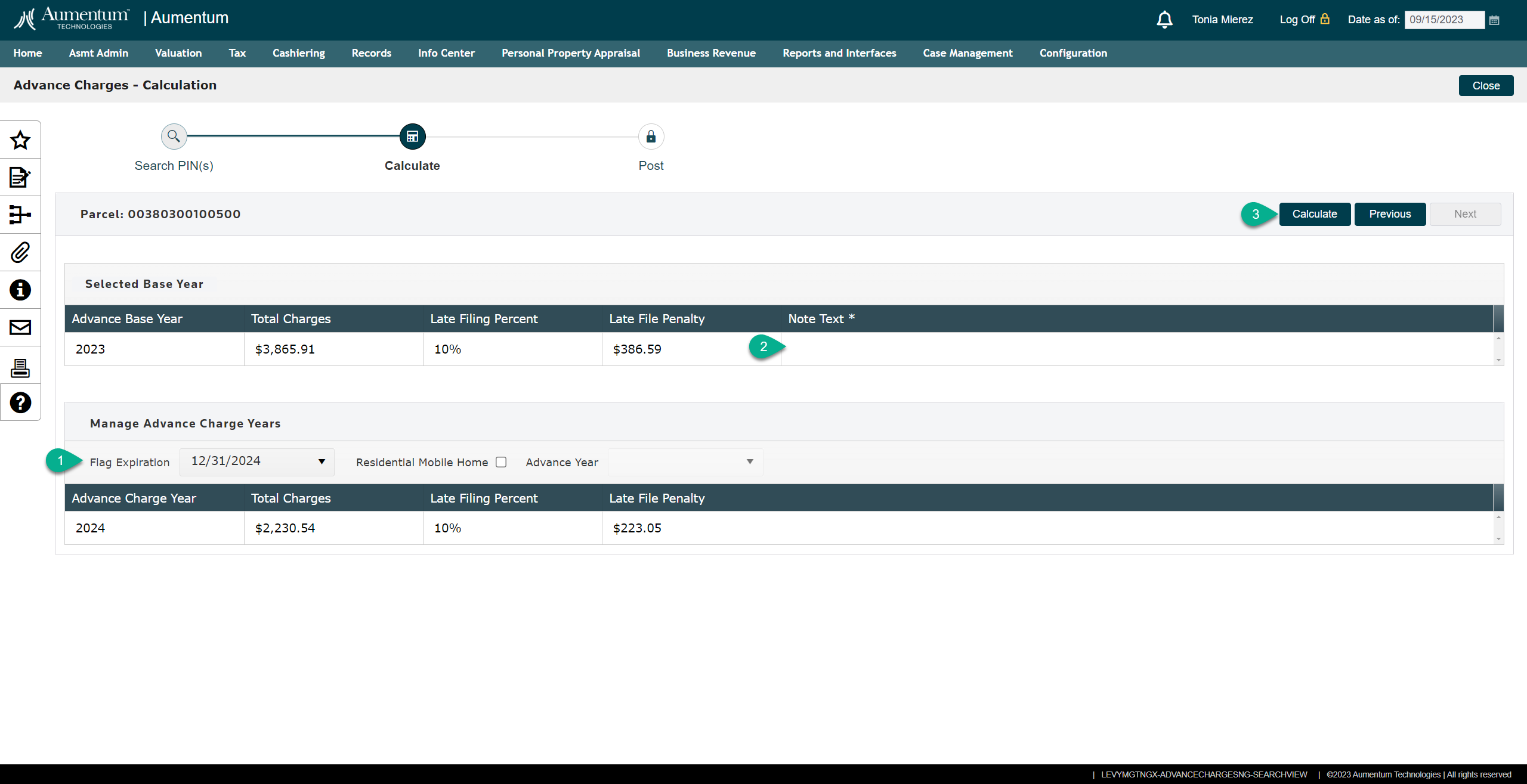

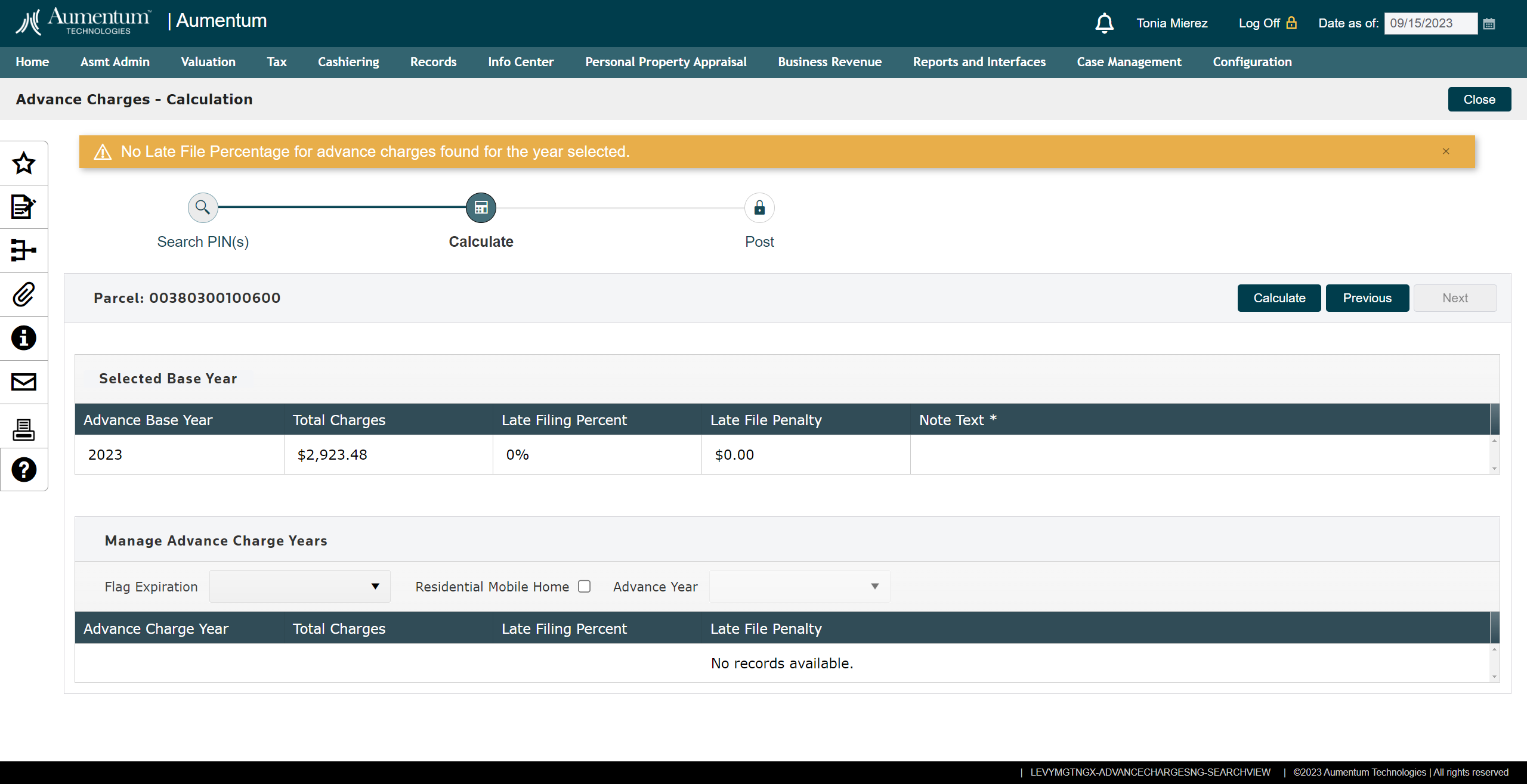

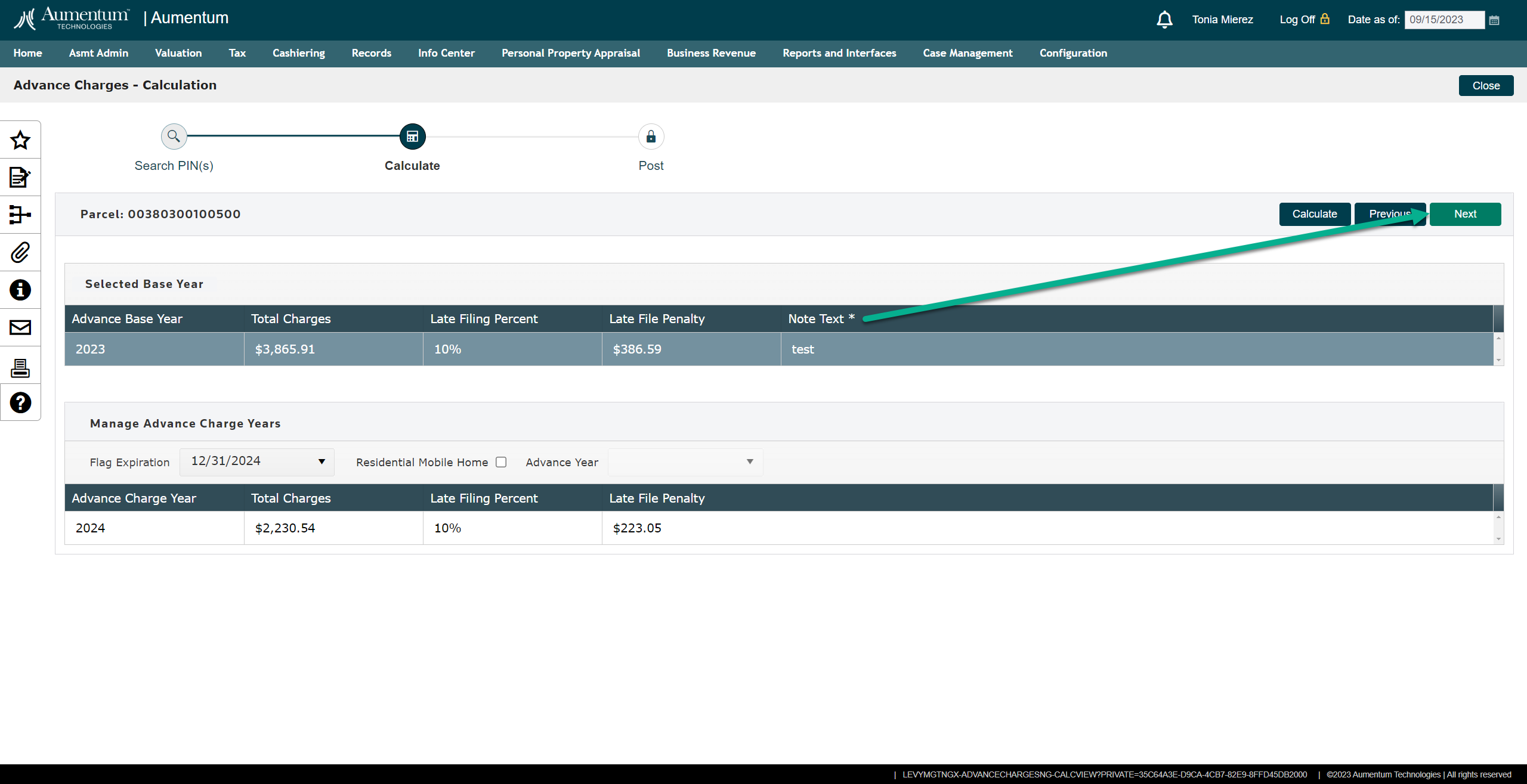

Step 2: Calculate

In the Calculate step, you will calculate advance charges and add notes for user visibility on the tax bills.

Base Year and Overrides

-

The Base Year is set to the Current Tax Year but can be overridden.

-

Available base year options include 2 prior years and 3 future years.

-

If the base year is correct, the user will SELECT the Flag Expiration Date

-

The date will be the calendar year end for the number of years that you wish to add an Advance Charge.

-

i.e.; If the base year is 2023 and there are two future Advance Year's you will select 12.31.2025, if there is only one year of Advance Charges to add, select 12.31.2024

-

Aumentum will check for future year values based on Flag Expiration, excluding Residential Mobile Homes.

-

-

-

Enter the required note text. (The NEXT button will not enable until the note text has been entered by the user.)

Residential Mobile Home

-

For Residential Mobile Homes, bills will not be held via an expiration date.

-

The Advance Year definition must be selected by the user. Aumentum allows for the Advance Year to extend up to 3 tax years beyond the selected Base Year.

-

This allows Real Property (Land Values) to be extended with the new year tax roll while ensuring Advance Charges are managed differently for mobile homes.

-

Residential Mobile Homes in Washington State are managed for Advance Charges by exempting them from the "Flag Expiration" mechanism, allowing Real Property (Land Values) associated with them to be extended with the new year tax roll, and including any Advance Charges in the standard tax bill for the relevant tax year. This approach ensures that Residential Mobile Home owners are billed and pay their taxes in a manner consistent with the state's tax regulations while accommodating their unique characteristics.

Advance Charge Year Grid

Columns in this grid are disabled and all data will be determined by the Flag Expiration Date.

Flag Expiration

The flag expiration date does two things. 1. It is used by RPA and/or AA to provide the correct future year (Advance Year) values for Advance calculations. 2. The records are flagged as Advance Charges based on the number of years that are associated with this PINs Advance Charges.

-

Flag Expiration Date is required.

Disabled Columns

-

Some columns in the grids are not editable.

Alerts

Aumentum will display warning, success, informational or failed alerts when an activity is finished or needs your attention by the user.

Calculate

After entering the note text, click the [CALCULATE] button, this will initiate the calculation.

The "NEXT" button will enable when the note text has been entered.

Late Filing Percent and Penalty

-

Late Filing Percent is provided by the Assessor and displayed in the UI.

-

Late Filing Penalty is calculated as (Total Charges * LFP% = Penalty Amount) and displayed in the page and printed on the billing statement.

Step 3: Post

In this step, you will finalize the process.

Posting Charges and Printing Tax Statement

-

After validating calculations in step 2 (calculate), click [NEXT] to proceed to Step 3.

-

Select the Report you wish to print (Itemized Property Tax Statement is recommended for this process)

-

To post charges and print the Tax Statement, click [Post].

-

The page will be navigated to the report for printing.